Vancouver, B.C., June 8, 2021. Northstar Gold Corp. (CSE:NSG ; FSV:3WV) (“Northstar” or the “Company”), announces the Company has signed an Option Agreement (or “the Agreement”) to acquire 100% interest in the 64 hectare Searles Patent (or “the Searles Property”) situated 18 km southeast of Kirkland Lake, Ontario.

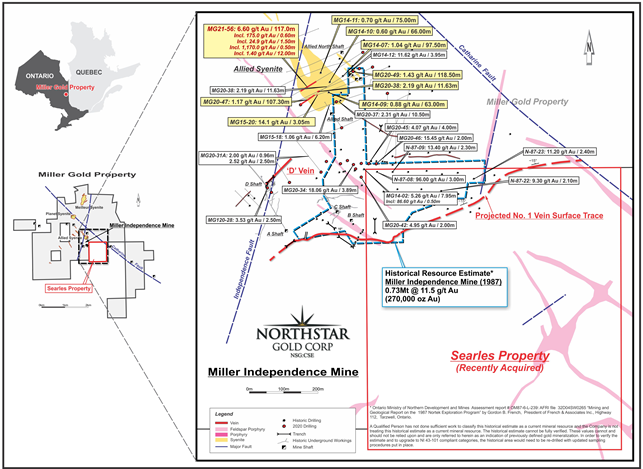

The Searles Property represents a portion of a historical resource estimate* (1987) of 0.73Mt grading 11.5 g/t Au** (for a total of 270,000 contained ounces of gold) on the No. 1 Vein of the Miller Independence Mine (Figure 1). The historical resource estimate straddles both the Searles Property and Northstar’s adjoining Miller Gold Property to the west and this Agreement consolidates Northstar’s control of the entire historical resource estimate area.

* Ontario Ministry of Northern Development and Mines Assessment report # OM87-6-L-239: AFRI file 32D04SW0265 "Mining and Geological Report on the 1987 Nortek Exploration Program" by Gordon B. French, President of French & Associates Inc., Highway 112, Tarzwell, Ontario.

**A Qualified Person has not done sufficient work to classify this historical estimate as a current mineral resource and the Company is not treating this historical estimate as a current mineral resource. The historical estimate cannot be fully verified. These values cannot and should not be relied upon and are only referred to herein as an indication of previously defined gold mineralization. In order to verify the estimate and to upgrade to NI 43-101 compliant categories, the historical area would need to be re-drilled with updated sampling procedures put in place.

Click here to view a Proactive Canada interview with Stephen Gunnion and Northstar CEO Brian Fowler detailing the significance of the Searles Property Option Agreement.

No.1 Vein Drill Results – Past and Present

Reported historic No. 1 Vein diamond drill hole intersections on the Searles Property (1987)* span a 330 metre strike length and include 96.0 g/t Au over 3m and 13.4 g/t Au over 2.3m at the west end, and 11.2 g/t Au over 2.4m at the east end (Figure 1). These results compliment subsequent 2014 and 2020 Northstar No. 1 Vein drill results on the adjoining Miller Gold Property that include 86.6 g/t Au over 0.5m, 18.0 g/t Au over 3.9m and 15.4 g/t Au over 2.0m to the west.

Historic and recent No. 1 Vein drilling by Northstar has defined the high-grade quartz-telluride vein as a continuous structure ranging in true width from 0.5m to 15m, spanning a 1 km northeast strike length and extending 750m down dip to the northwest. No. 1 Vein bisects the Allied Syenite at depth, where it expands in width and forms a major component of the newly defined bulk-tonnage Allied Gold Zone. The No. 1 Vein remains open in all directions

Figure 1. Miller Independence Mine Area – No. 1 Vein Drill Results

“The Searles Property acquisition was a long time coming and is a key part of our Miller Gold Property consolidation strategy”, states George Pollock, Northstar’s V.P. Exploration. “Northstar can now focus on validating the No.1 Vein historic results on the Searles Property quickly by drilling a limited number of short, confirmatory twin holes and step-outs along the shallow, north-dipping high-grade gold-telluride mineralized structure. The Allied Deformation Zone extends southeast onto the Searles Property and is host to numerous syenitic intrusions that remain largely unexplored. Exploration potential for deeper, sheeted gold-telluride bearing quartz veins and gold bearing syenite on the Searles Property is excellent.”

Searles Property Agreement Terms

To earn a 100% interest in the Searles Property, Northstar has agreed to the following option terms (All dollar amounts in CAD unless specified otherwise):

- Cash payment of $75,000 and issuance of 250,000 Northstar common shares upon signing.

- Cash payment of $75,000, issuance of 200,000 Northstar common shares and completion of $100,000 in exploration expenditures by the first anniversary of signing for 50% interest in the Searles Property.

- Cash payment of $150,000, issuance of 200,000 common shares and completion of $100,000 in exploration expenditures by the second anniversary of signing for 100% interest in the Searles Property.

- The Vendors retain a 2.5% Net Smelter Return (NSR). Northstar has the right to purchase 1% of the NSR for $1.5 million and an additional 0.5% NSR for $1 million. Northstar retains a standard right of first refusal on any proposed sale or transfer by Searles of the remaining 1% of the NSR.

- Northstar shall pay the Vendors US$20 per ounce for any National Instrument 43-101 Measured, Indicated, and Inferred mineral resource ounce delineated on the Searles Property, determined as at and payable upon the commencement of Commercial Production, subject to a maximum payment of US$15 million. The parties acknowledge and agree that the ounces shall be verified by a formal feasibility study initiated by Northstar at the time of production.

Summer Phase IIB Drill Program

Northstar is positioning to resume drilling at the Miller Gold Property in late July 2021 with a planned 4,600 metre, Phase IIB drill program to expand the recently discovered Allied Syenite Gold Zone, test several 3D IP geophysical anomalies and expand and confirm the No. 1 Vein historic estimate on the Miller Gold Property and recently acquired Searles Property.

2021 Surface Stripping, Mapping and Sampling Program

The Company is fully permitted and will conduct surface stripping in multiple areas of the Miller Gold Property, including the vicinity of the Allied Syenite where visible gold and gold tellurides have been observed, to provide for geological mapping and additional sampling. Surface stripping has proven to be highly effective in defining new mineralized zones on the Property as overburden is generally thin. This work will commence in early July.

About the Miller Gold Property

The Company’s flagship property is the 100% owned Miller Gold Property, situated 18 km southeast of Kirkland Lake and Kirkland Lake Gold’s Macassa SMC gold mine. Northstar drilled 5,023 metres in 28 holes at Miller in 2020, targeting near-surface high-grade and bulk-tonnage gold-telluride mineralization at Miller. Four new high-grade vein structures (Vein 1, 2, 3 and 4) (86.6 g/t Au / 0.5 metres and 18.0 g/t Au / 3.9 m; incl. 100.0 g/t Au / 0.6m) and the bulk-tonnage Allied Gold Zone (1.4 g/t Au over 118.5m and 1.2 g/t Au over 107.3m) were expanded / discovered and 3D modeled.

Northstar also commissioned a $350,000 property-wide 3D IP, gravity and magnetic geophysics program on the Miller Gold Property in 2020 to further define gold mineralization controls at depth.

During the period March 15th – April 27th, 2021, Northstar drilled 1,990 metres (8 holes) in a Phase IIA program following up the 2020 near-surface bulk-tonnage Allied Syenite Gold Zone discovery (2 holes), near-surface confirmation drilling of the historic gold-telluride No. 1 Vein (2 holes) and 4 holes targeting geophysical and machine learning anomalies. Mineralized intercepts were obtained in all 8 Phase IIA drill holes and the Company will report assay results when available.

On May 27th, 2021 Northstar announced partial results from drill hole MG21-56 in the Allied Syenite Gold Zone that included 6.6 g/t Au over 117m between 14m and 131m encompassing the Veins 1 – 4 zones, including 175 g/t Au over 0.6m between 14m and 14.6m, 24.9 g/t Au over 1.5m between 43m and 44.5m, and 1,170 g/t Au over 0.5m between 69.5m and 70m depth in drill hole MG21-56 within the Allied Syenite.

Qualified Person

Trevor Boyd, PhD, P.Geo., a ‘Qualified Person’ (Q.P.) as defined under Canadian National Instrument NI 43-101, has reviewed technical aspects of this news release.

About Northstar Gold Corp

Northstar’s flagship property is the 100% owned Miller Gold Property, situated 18 km southeast of Kirkland Lake and Kirkland Lake Gold’s Macassa SMC gold mine. The Kirkland District is being explored by numerous junior gold companies and subject to recent consolidation efforts by major companies active in the District. Northstar spent $2 million in exploration at Miller in 2020, resulting in the expansion / discovery of four new high-grade vein structures (Vein 1, 2, 3 and 4) and the near-surface bulk-tonnage Allied Gold Zone. Northstar recently closed an over-subscribed $2.7 million financing and completed a 1,990 metre Phase IIA follow up diamond drill program at Miller on April 27th, 2021. The Company is currently awaiting assay results in preparation for a follow-up Phase IIB drill program scheduled to commence in late July, 2021.

Northstar has 3 additional 100%-owned exploration projects in northern Ontario, including the recently acquired 1,200 ha Rosegrove Property situated 0.5 km from the Miller Gold Property, the 4,500 ha Bryce Property, an intrusive-gold / PME VMS project located along the projected east extension of the Ridout Break, and the recently expanded Temagami-Milestone Cu-Ni-Co Property located in Strathcona Township. Northstar is advancing all 3 properties to the NI 43-101 Technical Report stage to maximize geological understanding, increase investor awareness and optimize monetization opportunities.

On behalf of the Board of Directors,

Mr. Brian P. Fowler, P.Geo.

President, CEO and Director

(604) 617-8191

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain forward looking statements which involve known and unknown risks, delays, and uncertainties not under the control of Northstar Goldcorp. which may cause actual results, performance or achievements of Northstar Gold Corp to be materially different from the results, performance or expectation implied by these forward looking statements. By their nature, forward looking statements involve risk and uncertainties because they relate to events and depend on factors that will or may occur in the future. Actual results may vary depending upon exploration activities, industry production, commodity demand and pricing, currency exchange rates, and, but not limited to, general economic factors.