Vancouver, B.C., July 26, 2022. Northstar Gold Corp. (CSE:NSG, OTCQB:NSGCF) (“Northstar” or the “Company”), announces Ronacher McKenzie Geoscience Inc. (“Ronacher McKenzie”) and SRK Consulting (Canada) Inc. (“SRK”) have completed 3D deposit modeling and geostatistical gold and tonnage range estimations for the main Allied Gold Zone (including Vein 1) at the Company’s 100%-owned Miller Gold Property, situated 18 km southeast of Kirkland Lake, Ontario.

Miller Gold Property Exploration Target Study Highlights and Important Implications

- The Allied and Vein 1 Exploration Targets remain open to expansion with potential to increase tonnage and gold grade by additional drilling.

- Target Study gold grade range estimates of 1.39 to 2.04 g/t Au may provide a reasonable prospect of achieving a mineral resource with increased tonnage.

- Vein 1 South, with a grade range of 4.80 to 7.54 g/t Au, represents a high-grade gold target open to expansion, with potential to contribute to a future mineral resource estimate that may provide basis for an underground mining evaluation study.

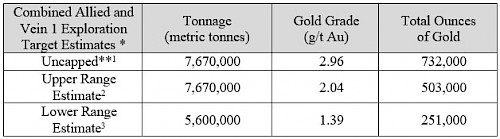

Exploration Target Study Estimation results are illustrated below in Table 1.

Table 1. Exploration Target Estimates for the Allied and Vein 1 Gold Zones

“The SRK Miller Gold Property Exploration Target Model Study is a milestone achievement for Northstar Gold Corp.”, states Brian P. Fowler, P.Geo., President, CEO and Northstar Director. “The Company now has 3rd party validation that the Allied Gold Zone and Vein 1 Zone have the potential to host significant near-surface gold resources with expansion potential. Northstar is one step closer to achieving our corporate strategy of defining a +1 million ounce gold resource at Miller.”

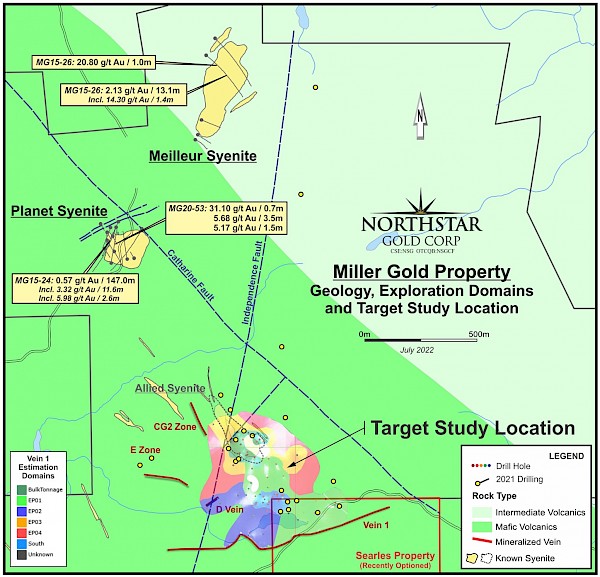

“Exploration Target Study results overlay less than 20% of the Miller Gold Property (Figure 1) and do not include numerous additional gold exploration targets and recent discoveries. Northstar is positioning to conduct additional drilling on the Allied, Planet and Meilleur Syenite gold targets in a Phase III program, with a focus on Allied Gold Zone expansion drilling.”

Drilling outside of the Target Area has provided long intercepts (50 metres to 150 metres) of near surface, lower grade (0.5 to 1.5 g/t) gold mineralization at two additional and nearby Syenite intrusions, with a 100-metre wide stockwork zone in the Meilleur Syenite yielding 2.13 g/t Au over 13.05 metres and a 147.2 metre intersection averaging 0.60 g/t Au at the Planet Syenite.

The Exploration Target Study area is illustrated below in Figures 1, 2 and 4. Estimation results are based on 130 of 471 drill holes completed on the Allied and Vein 1 Gold Zones to date, both of which remain open at depth, along strike and down dip.

Figure 1. Miller Gold Property Exploration Target Study Area

Factors affecting the Exploration Target Gold Grade Estimate(s)

- Nugget Effect and Gold Distribution – Even though anomalous gold values are widespread in both the matrix of the Allied Syenite as well as Veins 1 to 6, the “nugget effect” or occasional high grades (up to 1,170 g/t Au) with abundant coarse visible gold and gold tellurides encountered in both the Vein 1 Zone and the Allied Bulk Tonnage Gold Zone have a disproportionate impact on the overall grade estimations producing a substantial difference between capped and uncapped grade values. In fact, gold losses due to capping ranged from 53% to 63% within the Allied Bulk Tonnage Gold Zone. Additional sampling will be required to determine the true frequency of these bonanza type veins on the Property. Brecciation and secondary gold enrichment of shallow dipping quartz veins associated with late cross cutting northeast striking brittle fault structures such as the IFZ East could play a critical role in influencing the emplacement of coarse gold within the Allied Syenite and on the Miller Property as a whole.

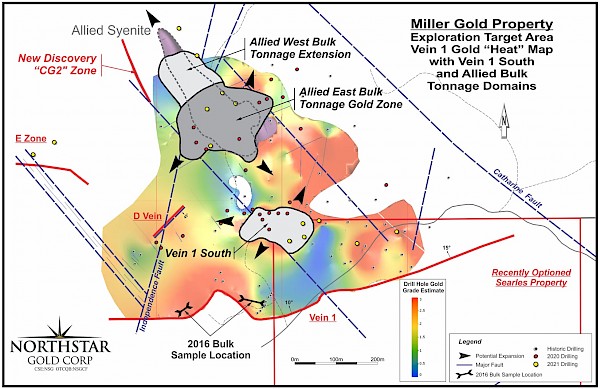

- Drilling/Sampling Density – The recent and historic drilling density is highly variable across both the Allied Bulk Tonnage Gold Zone as well as the Vein 1 Zone. This creates a range in confidence levels across various domains with only the Allied East Bulk Tonnage Gold Zone and the Vein 1 South Zone (Figure 2) achieving a high confidence level due to their higher drilling densities. The estimated tonnage and grade in the Vein 1 South Zone (82,000 tonnes with an average grade ranging from 4.80 g/t Au* (20 g/t Au grade cap) to 7.54 g/t Au* (60 g/t Au grade cap), with an uncapped grade estimate of 15.86 g/t Au**) is comparable to the 5.1 g/t Au mill head grade for a 932 tonne representative bulk sample collected from Vein 1 in 2016. Low drilling density and under sampling can have a detrimental effect on grade estimation.

- Exploration Target Boundary Definition - Both the Allied Bulk Tonnage GOld ZOne and the Vein 1 Zone remain open along strike and down dip with the surface outcrop trace of Vein 1 being the only definitive boundary to date. The high confidence domains of the Allied East Bulk Tonnage and Vein 1 South zones remain open and undefined in multiple directions, adding further potential for significant expansion. (Figure 2)

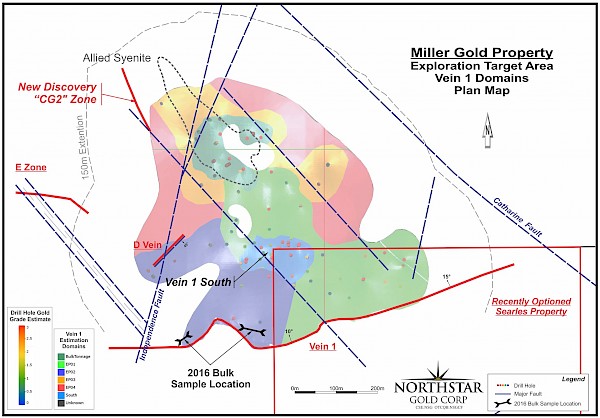

- New Au-Cu CG2 Zone Discovery not Included in Estimations– The new, steeply-dipping Au-Cu “CG2 Zone” (Figures 1-4) gold-bearing sulphide discovery in drill hole MG21-65 that assayed 9.41 g/t Au and 1.03% Cu over 3m (from 260m to 263m) was not included in the current estimates as additional borehole geophysics and follow-up drilling are required for proper modeling.

- Surface Channel Samples not Included in Estimations – SRK elected not to include the extensive Miller Gold Property surface channel sample database (601 samples) within their Exploration Target Study. This includes 2021 surface stripping areas C1 and C2, southeast of the Allied Syenite which produced high-grade length weighted assays up to 14.79 g/t Au over 7m.

- 2016 No. 1 Vein Bulk Sample Results not Included in Estimations – A fully diluted 932-tonne bulk sample collected by Northstar in 2016 from two surface trenches, located 170 metres south-southwest and 190m southwest of the Vein 1 South Zone, graded 5.1 g/t Au. (Figures 2 and 4)

Figure 2. Vein 1 Gold “Heat Map” with Vein 1 South, Allied West and Allied East Domain Projections

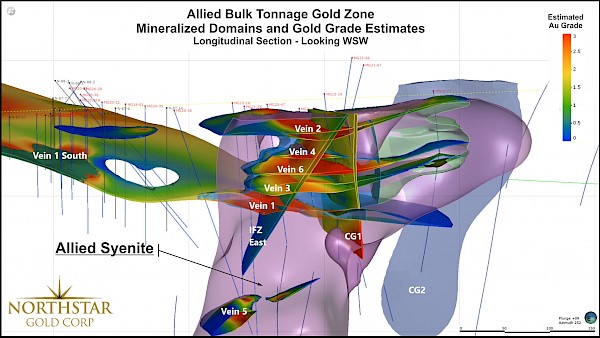

Figure 3. Allied Gold Zone Longitudinal Section and Gold Grade Estimates

Estimation Methodology

Exploration Target estimates, contained within 12 - 3D modeled domains of the Allied and Vein 1 Zones (Figures 1 to 4, Table 1), were estimated by detailed 3D modeling using LeapfrogTM software. Tonnage and gold grades were estimated from a block model incorporating the average density estimates for major rock units within the Abitibi Greenstone Belt (Eshaghi et al. 2019) and a series of ordinary kriging interpolations using a simple one exponential structure variogram model. Both Inverse Distance Weighting and Ordinary Kriging frameworks were used and compared to each other. Sensitivities include hard and soft boundaries, search volumes and two levels of gold grade capping in the veins with a lower grade cap used in the host lithology. Tonnage and gold grade estimation ranges were generated using all available recent and historic drilling data within the study area (130 holes). Extensions of 150m were added to the Vein 1 Zone (Figure 4) projecting possible expansion of Vein 1 into areas where it remains open.

Recent drill hole Optical and Acoustic Televiewer surveying by DGI Geoscience Inc. augmented similar data collected in 2021, providing additional basis for 3D geometrical interpretation of geological features such as veins and faults.

Figure 4. Allied / Vein 1 Mineralized Domain Surface Plan Map

The Near-Surface Allied Bulk Tonnage Gold Zone

Northstar has completed 14,988.5 metres of drilling in 71 diamond drill holes at the Miller Gold Property since 2014, including 6,332 metres in 22 holes within the Allied Syenite to date. Recent exploration and step-out drilling has encountered widespread anomalous gold values with multiple +100 gram-metre gold intercepts. Drilling in 2021 successfully doubled the volume of the Zone, which remains open at depth and along strike.

The near-surface Allied East Bulk Tonnage Gold Zone (Figure 2 and 3) represents approximately two-thirds of the known area of the Allied Syenite on surface but accounts for greater than 95% of the total sampling to date within the Allied Exploration Target model. Additional drilling will be required in the Allied West Bulk Tonnage Extension located northwest of the Independence Fault (Figure 2) and in sub vertical targets within the Allied East Bulk Tonnage Gold Zone such as the IFZ East and the newly discovered CG1 Zone (4.74 g/t Au, 0.51% Cu over 6.4m from 151.1m to 157.5m in MG21-64) (Figure 3). It should be noted that the length weighted assay intervals of drilling intercepts within the Allied Syenite ranged between 1.14 g/t Au using a low-grade cap, 1.28 g/t Au with a higher cap to 2.04 g/t Au with no capping, which correlates well with the range of grade estimates calculated by SRK in the 3D model of the Allied Bulk Tonnage Gold Zone. All zones associated with the Allied Syenite remain open in multiple directions.

IFZ East – Potential Feeder Zone in the Allied Syenite

Structural data collected in 2021 from drill holes MG20-47, MG21-55, and MG21-56 by DGI Geoscience Inc. using both OTV (Optical Televiewer) and ATV (Acoustic Televiewer) surveying technology successfully identified a northeast striking, -58° southeast dipping brittle fault zone cross cutting the Allied Syenite. The IFZ East Fault (Figure 3) intersected in drill holes MG20-47, MG21-56 and MG21-70 is characterized by a halo of strong pervasive hydrothermal chlorite alteration and fracturing surrounding chlorite rich fault breccias +/- chalcopyrite, typically 3 to 7 metres in true width. The IFZ East and main branch of the Independence Fault crosscut shallow dipping quartz veins in the hangingwall of Vein 1 within the Allied Syenite.

The lines of intersection between the IFZ East structure and several shallow dipping quartz veins are proximal to numerous higher grade gold intercepts and may reflect a process of secondary gold enrichment of pre-existing quartz veins at the Miller Gold Property. The abundant cross fracturing along the lines of intersection created zones of enhanced permeability and brecciation with subsequent introduction of gold, bismuth and tellurium bearing magmatic hydrothermal fluids along a geothermal gradient extending to depth. The results of drill hole MG21-70 (4.0 g/t Au over 50.6m and 2.3 g/t Au over 8m within the IFZ East from 175m to 183m) indicate that these structures are important for secondary enrichment of gold within the Allied Gold Zone and represent important steeply-dipping feeder zones of gold mineralization extending to depth within the Allied Syenite.

Additional drilling is required along the Independence Fault and IFZ East fault branch in the vicinity of the Allied Syenite.

Vein 1 Gold Zone – Open in Multiple Directions

The Vein 1 Zone on the Miller Gold Property is a shallow north dipping fault-fill zone of quartz veining between 0.35m and 20m in thickness with an average 2.6m thickness in the mafic volcanics, covering a known area 600 metres east-west x 700 metres north-south (Figures 1 and 2). Gold is widely disseminated in the Vein 1 Zone, is most frequently associated with disseminated pyrite and occasionally occurs as coarse native gold or gold tellurides in higher grade pockets. The Vein 1 South Zone represents only a small fraction (less than 10%) of the overall volume of the Vein 1 Zone measuring an area of 170 metres x 80 metres where drilling density is higher and includes some high-grade drilling intercepts with coarse visible gold and gold tellurides between 40m and 60m vertical depth. Further exploration is required to define the boundaries of the Vein 1 South Zone which remains open in multiple directions.

Miller Gold Property Phase III Exploration Plans

Northstar’s Phase III Miller Gold Property exploration plan will include a diamond drilling program with the following objectives:

-

- Expanding the Allied Bulk Tonnage Gold Zone along the northwestern extension of the Allied Syenite around drill hole MG21-65 (0.90 g/t Au over 29.7m), west of drill hole MG21-56 (6.6 g/t Au over 117m) and to the southeast of drill holes MG21-70 (4.0 g/t Au over 50.6m) and drill hole MG21-49 (1.43 g/t Au over 118.5m) in stripping areas C1 and C2.

- Follow-up drilling of new sub vertical discoveries CG2 (9.41 g/t Au, 1.03% Cu over 3.0m in MG21-65) to the west of the Allied Syenite, along with CG1 (4.71 g/t Au, 0.51% Cu over 6.4m in MG21-64) and the IFZ East fault within the Allied Syenite which are associated with higher concentrations of coarse gold and gold tellurides within syenite hosted shallow dipping quartz veins.

- Expanding the Vein 1 South Zone in multiple directions, and

- Follow-up drilling of IP-RES anomalies and historic high grade drilling intercepts in the Vein 1 Zone, particularly in the vicinity of cross cutting northeast striking fault structures such as the Independence Fault Zone.

The data collected from the recent Abitibi Geophysics borehole IP survey will be utilized to refine the Company’s drill targeting and planning process.

On a longer-term basis, the Company plans to carry out additional exploration in the vicinity of the Planet and Meilleur Syenites where recent and historic drilling encountered highly anomalous gold values and several IP-RES anomalies remain untested.

Qualified Person

Trevor Boyd, PhD, P.Geo., a ‘Qualified Person’ (Q.P.) as defined under Canadian National Instrument NI 43-101, has reviewed technical aspects of this news release.

About the Miller Gold Property

Northstar’s flagship property is the 100% owned Miller Gold Property (“Miller”), situated 18 km southeast of Kirkland Lake and Agnico Eagle Mines’ Macassa SMC gold mine. The Miller Gold Property is highly prospective for the discovery of a large-scale, higher grade gold system similar to the deposits of the Kirkland Lake camps that produced over 24 M oz. of gold from 7 mines (Clark 2013). Geologically, Miller is believed to be a close analog to Agnico Eagle Mines’ Macassa SMC gold mine, given the numerous geological similarities. Both Miller and the newly discovered lower SMC at Macassa share the similar formation, age and mineralization style (gold-telluride vein system with calaverite the main gold mineral). Both deposits are also located next to a First Order fault structure (Catharine Fault Zone at Miller Property and the Larder Break at Kirkland Lake) potentially sharing a gold enriched magmatic reservoir at depth.

The Kirkland District is being explored by major and junior gold companies alike with some significant consolidation transactions recently announced and completed. Since going public by IPO in late 2020, Northstar has spent nearly $4 million in exploration at Miller in 2020 and 2021, resulting in the expansion / discovery of a series of broad, shallow dipping sheeted quartz-gold-telluride vein structures in the Allied Syenite (Allied Gold Zone) and Planet Syenite, with numerous 70 - 770 gram/metre drill hole intercepts. Northstar completed a 14 hole, 2,495 metre Phase IIB diamond drill program at Miller on November 27th, 2021, following up a previous 8 hole, 1,990 metre Phase IIA drill program completed in late April, 2021. In 2021 Northstar also completed an enhanced surface stripping, mapping and sampling program targeting near-surface gold mineralization over the Allied Syenite, No. 1 Vein and other areas on the Miller and recently acquired adjoining Searles Patent.

The Allied Gold Zone has now been defined by drilling and surface sampling to encompass an area measuring >350 metres X 200 metres and remains open along strike to the northwest and southeast. Drilling to date at the Allied Gold Zone has intersected 6.6 g/t Au over 117.0 metres, 4.0 g/t Au over 50.6 metres, 1.4 g/t Au over 118.5 metres, and 1.2 g/t Au over 107.3 metres. Drilling to date has also yielded long intercepts (50 metres to 150 metres) of near surface, lower grade (0.5 to 1.5 g/t) gold mineralization at two additional and nearby Syenite intrusions, with a 100-metre wide stockwork zone in the Meilleur Syenite yielding 2.13 g/t Au over 13.05 metres and a 147.2 metre intersection averaging 0.60 g/t Au at the Planet Syenite.

As a precursor to a Mineral Resource Estimate and for reporting purposes, Northstar commissioned Ronacher McKenzie Geoscience Inc. and SRK Consulting (Canada) in April, 2022 to develop an Allied Syenite Gold Zone and No. 1 Vein Exploration Target model. This will provide the Company and investors a range of current conceptual tonnage and gold grades at the Miller Gold Property and provide basis for continued expansion drilling and mineral resource development. Results of this work are reported herein.

Other Northstar Exploration Properties

Northstar has 3 additional 100%-owned exploration projects in northern Ontario, including the recently acquired 1,200 ha Rosegrove Property situated 0.5 km from the Miller Gold Property, the 4,650 ha Bryce Gold Property (includes the recently optioned Britcanna Lease), an intrusive-gold / PME VMS project located along the projected east extension of the Ridout Break, and the recently expanded Temagami-Milestone Cu-Ni-Co Property located in Strathcona Township. Northstar recently filed a NI43-101 Technical Report on the Bryce Gold Property and is advancing all 3 properties to enhance monetization opportunities.

On behalf of the Board of Directors,

Mr. Brian P. Fowler, P.Geo.

President, CEO and Director

(604) 617-8191

bfowler@northstargoldcorp.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain forward looking statements which involve known and unknown risks, delays, and uncertainties not under the control of Northstar Goldcorp. which may cause actual results, performance or achievements of Northstar Gold Corp to be materially different from the results, performance or expectation implied by these forward looking statements. By their nature, forward looking statements involve risk and uncertainties because they relate to events and depend on factors that will or may occur in the future. Actual results may vary depending upon exploration activities, industry production, commodity demand and pricing, currency exchange rates, and, but not limited to, general economic factors.