Vancouver, B.C., April 19, 2023. Northstar Gold Corp. (CSE:NSG, OTCBQ:NSGCF) (“Northstar” or the “Company”), announces that a high resolution airborne magnetic survey completed over the Company’s 100%-owned, flagship Miller Gold Property situated 18 km southeast of the town of Kirkland Lake, has identified a volumetrically large positive magnetic anomaly (SM-01) partially underplating the near-surface Allied Gold Zone and syenite stock (Figures 1 and 2). The SM-01 Anomaly displays a high magnetic susceptibility signature, possibly reflecting a deeper large, discrete mafic intrusion and source area for higher, recently discovered steeply dipping Au-Cu sulphide mineralization discovered in 2021 drill holes MG21-64 (4.71 g/t Au, 0.51% Cu over 6.4m – CG1 Zone) and MG21-65 (9.41 g/t Au, 1.03% Cu over 3.0m – CG2 Zone). Eleven additional anomalies consistent with possible syenite intrusions (Figure 3) have also been identified.

“The Miller UAV magnetic survey results are a potential game changer that indirectly supports the premise the Allied Gold Zone is the late-stage, shallow-dipping carapace of an earlier deep-seated, multi-phase gold-copper mafic intrusion-related system, similar in style to Agnico Eagle’s advanced Upper Beaver Project situated 18 km north of the Miller Gold Property”, states Northstar CEO and Director Brian P. Fowler, P.Geo. “Alkalic gold-copper deposits such as Upper Beaver have demonstrable vertical copper-gold mineralization and grade continuity that may support both open pit and underground exploitation. Northstar is positioning to confirm this new Allied Gold Zone geological model and deeper gold-copper mineralization potential by diamond drilling this summer.”

The 13 square km, 296-line km airborne UAV high resolution magnetic survey was completed by Val d’or based Abitibi Geophysics utilizing a high resolution AeroVision® MAG-drone survey system with 30m to 35m terrain clearance between February 9th and 13th 2023. Abitibi performed an unconstrained 3D magnetic inversion of the residual magnetic field over the entire survey area to a projected depth of ~1500m, and over two focus areas including the Allied, Planet and Meilleur Syenites to a projected depth of ~900m. The primary objective was to define copper-gold geological and structural controlling features at depth on the Miller Gold Property. Targeting analysis was performed by using an automatic (unsupervised) predictive method known as Centre for Exploration Targeting (CET) grid analysis.

Future Plans

Property-wide targeted surface mapping, sampling and prospecting programs are planned to follow-up recent UAV magnetic survey results on both of the Miller Gold and Rosegrove Properties

Northstar is positioning to expand the Allied Gold Zone, confirm new geophysical insights and target deeper gold-copper mineralization by diamond drilling at the Miller Gold Property this summer.

UAV Mag Survey Results

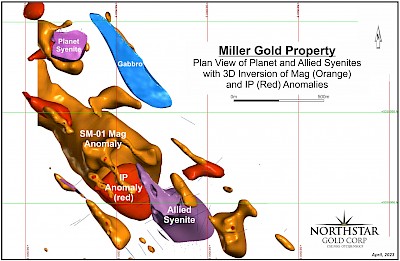

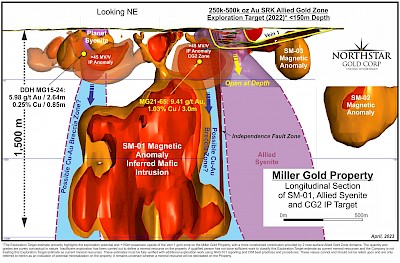

A 3D inversion of residual magnetic anomaly data covering the Miller Gold Property identified a volumetrically large (>1,000 metres in vertical extent x 1,000 metres in strike x 400 metres in width) positive magnetic anomaly termed “SM-01” as the primary feature dominating the 3D model.

SM-01 (Figures 1 and 2), is a steeply dipping rooted source that exceeds 0.15 SI (Magnetic susceptibility expressed as susceptibility per unit volume) located between the Allied and Planet Syenites. The anomaly appears to occupy the hanging wall of the Catharine Fault Zone which is dipping steeply to the southwest and underplates much of the Allied Deformation Zone.

Both the high magnetic susceptibility and drill hole data (MG15-22, MG21-69) suggest that the SM-01 anomaly likely represents a large-scale mafic intrusion cut by numerous northwest and northeast fault structures, syenite and feldspar porphyry dike swarms, and is bounded by the underlying Catharine Fault Zone and Independence Fault Zone towards the east. The Allied Syenite occupies much of the upper and eastern contact of the inferred intrusion where it’s cut by the Independence Fault Zone. The Allied Syenite also hosts the near-surface Allied Gold Zone, determined by a 2022 SRK Exploration Target Study*, to have an upper potential range exceeding 500,000 oz gold and averaging 2.04 g/t Au.

Potential Cu-Au Source and Feeder Zone(s)

Discoveries of high-angle gold and copper rich quartz-chlorite veins and breccias at depth in holes MG21-64 within a segment of the Independence Fault Zone, MG21-65 alongside a vertical feldspar porphyry dike near the western contact of the Allied Syenite, and MG21-70 (2.30 g/t Au over 8.0m – IFZ East) possibly manifest a structurally controlled, sub-vertical feeder system tapping a large, deep source area of gold and copper-bearing magmatic and hydrothermal fluids within the Allied Deformation Zone. The volumetrically large, inferred mafic intrusion termed “SM-01” underplates the Allied Deformation Zone and may be the source of metalliferous Cu-Au bearing hydrothermal fluids channeled upwards by structures such as sub vertical felsic dikes, tectonic breccias and contacts with proximal syenite lithologies such as the Allied Syenite (Figure 2).

Drill hole data from holes MG21-63 and MG21-64 suggest the Independence Fault Zone “IFZ” is a broad sub-vertical, brittle deformation zone likely representing the upward continuation of the faulted and brecciated contact of the inferred mafic intrusion at depth. The structure features abundant chlorite-quartz breccias with chalcopyrite mineralization and multiple occurrences of visible gold and tellurides, including an intercept of 4.71 g/t Au, 0.51% Cu over 6.4m from 151.1m to 157.5m within the CG1 Zone in DDH MG21-64. Drill hole MG21-65, collared near the northeast contact of the Allied Syenite, intercepted semi–massive pyrite with chalcopyrite over 3.6 metres (from 259.2 metres to 262.8 metres) grading 9.41 g/t Au, 1.03% Cu over 3.0m between 260m to 263m in the CG2 Zone within a larger halo of magnetite alteration, proximal to a feldspar porphyry dike contact.

Both the CG1 and CG2 Zones constitute excellent exploration targets that are highly chargeable, open to depth and can be traced along strike by magnetic and 3D IP geophysical surveys.

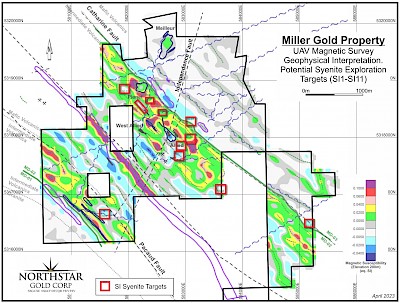

Additional Syenite Targets

In addition to the SM-01 magnetic susceptibility anomaly, 11 additional targets (SI-01 to SI-11 – Figure 3) with SI values consistent with syenite intrusions have been identified on the Property. Most of these anomalies are in the vicinity of the known Allied and Planet Syenites which along with the Meilleur Syenite would represent areas for potential near surface bulk tonnage expansion. Syenite targets SI-06 and SI-11 are both associated with high chargeability IP anomalies and will be priority targets for follow up in an upcoming spring exploration program on Miller. Some magnetic skarn development is apparent within a halo surrounding the Allied and Planet Syenites which bears some similarity with the Upper Beaver Intrusive Complex where mineralization is also dominated by copper enriched, oxidized and alkaline magmatic hydrothermal fluids with similar Fe-skarn development.

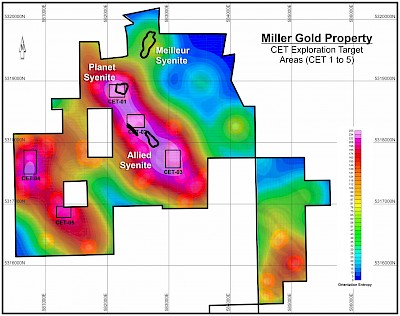

CET Targets

Centre for Exploration Targeting (CET) is an automatic image processing technique for prospectivity analysis of Archean lode-gold deposits in structurally complex areas that may have enhanced hydrothermal permeability prospective for gold mineralization.

The Miller Gold Property CET analysis highlighted five structurally complex zones (CET-01 to CET-05 - Figure 4). CET-01, CET-02 and CET-03 align west and parallel to Catharine fault along the Allied Deformation Zone. CET-01 is centred along the western contact of the Planet Syenite. CET-02 is favorably located between the Allied and Planet Syenites and correlates with the large magnetic susceptibility anomaly SM-01. CET-03 is found southeast of Allied Syenite and is encircled by SI-04, SI-05 and SI-06, as well as magnetic susceptibility anomaly SM-03. Similarly, CET-04 and CET-05 align west and parallel to the Pacaud Fault. The Pacaud Fault, which is proximal to the former producing Barry-Hollinger gold mine, strikes sub parallel to the Catharine Fault on both the Rosegrove and Miller Properties and represents another first-order regional structure.

Miller Exploration Target Model – Potential for Growth

In addition to the currently defined late stage, near-surface, shallow-dipping Au-Bi-Te enriched quartz veins of the Allied Gold Zone, the Miller Gold Property potentially hosts an underlying, large-scale multi-stage intrusion and related system of earlier stage subvertical skarn/porphyry-style Au-Cu quartz-chlorite-magnetite veins and gold-bearing sulphides in syenite and mafic volcanics.

The current SRK Exploration Target Estimate of the Vein 1 and Allied Bulk Tonnage Gold Zones (251,000 to 503,000 oz Au @ 1.39 to 2.04 g/t Au*) is limited to late-stage, shallow dipping telluride rich quartz veins and structures (Veins 1 to 6) found within 150 metres of the surface. While the bulk tonnage target estimate will likely be expanded with the discovery of additional near surface high grade mineralization or mineralized syenites, the Cu-Au discoveries in drill holes MG21-64 and MG21-65, which are not included in the current Target Estimate, appears to represent an earlier stage of sub vertical gold-copper sulphide mineralization contemporaneous with mafic intrusive tectonism within the Allied Deformation Zone. This style of mineralization, which was previously unknown on the Miller Property, highlights the potential for the discovery of a much larger potential resource extending to depth on the Property.

*The Exploration Target estimate primarily highlights the exploration potential and +150m expansion upside of the Vein 1 gold zone on the Miller Gold Property, with a more constrained contribution provided by 2 near-surface Allied Gold Zone domains. The quantity and grades are purely conceptual in nature. Insufficient exploration has been carried out to define a mineral resource on the property. A qualified person has not done sufficient work to classify this Exploration Target estimate as current mineral resources and the Company is not treating this Exploration Target estimate as current mineral resources. These estimates must be fully verified with additional exploration work using NI43-101 reporting and CIM best practices and procedures. These values cannot and should not be relied upon and are only referred to herein as an indication of potential mineralization on the property. It remains uncertain whether a mineral resource will be delineated on the Property.

In this context, the AeroVision® magnetic survey has played a key role in improving Northstar’s structural and geological understanding (mapping) and ability to target possible deep-seated copper-gold mineralization at the Miller Gold Property. Survey results delineate magnetic features that could be linked to key elements (structures and lithologies) that identify the location of deep seated copper-gold deposits, younger gold-bearing syenite intrusions and structural controls of mineralization.

Figure 1. Plan View of Planet and Allied Syenites with 3D Inversion of Mag (Orange) and IP (Red) Anomalies

Figure 2. Longitudinal Section Through the Allied Syenite with 3D IP and Mag Anomalies

Figure 3. Geophysical Interpretation of Magnetic Survey with Syenite Targets

Figure 4. CET Targets on the Miller Gold Property

Qualified Person

Brian P. Fowler, P.Geo., a ‘Qualified Person’ (Q.P.) as defined under Canadian National Instrument NI 43-101, has reviewed technical aspects of this news release.

Northstar Issues Shares to Settle Debts

Northstar also announces the Company has agreed to pay an aggregate of $88,458.88 in trade payables, consisting of an aggregate $53,458.88 (net of source deductions) owed to the directors of the Company for their accrued director fees since September 1 2021, 2022 and $35,000 to settle a working capital loan with a consultant of the Company (together, the "Group") via the issuance of 1,263,698 common shares in the capital of the Company (the "Settlement Shares") for services rendered by the directors up to March 31, 2023 and the loan from the consultant (the "Debt Settlement").

The Company will issue 1,263,698 Settlement Shares to the Group at a deemed price of $0.07 per Settlement Share, representing a one cent premium over the last closing price of $0.06 per common share. The Settlement Shares were issued in reliance on certain prospectus exemptions available under Canadian securities legislation and are subject to a four month and one day statutory hold period, which will expire on August 14, 2023.

As 763,698 of the Settlement Shares were issued to officers, directors and insiders of the Company, the Debt Settlement constituted a "related party transaction" pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company relied on exemptions from the formal valuation and minority approval requirements of MI 61-101 (pursuant to subsections 5.5(a) and 5.7(a)) as the fair market value of the securities distributed to, and the consideration received from, the related party did not exceed 25% of the Company's market capitalization. The Debt Settlement was approved by all of the directors of the Company.

About the Miller Gold Property

Northstar’s flagship property is the 100% owned Miller Gold Property (“Miller”), situated 18 km southeast of Kirkland Lake and Agnico Eagle Mines’ Macassa SMC gold mine. The Miller Gold Property is highly prospective for the discovery of a large-scale, higher grade gold system similar to the deposits of the Kirkland Lake camps that produced over 24 M oz. of gold from 7 mines (Clark 2013). Geologically, Miller is believed to be a close analog to Agnico Eagle Mines’ Macassa SMC gold mine, given the numerous geological similarities. Both Miller and the newly discovered lower SMC at Macassa share the similar formation, age and mineralization style (gold-telluride vein system with calaverite the main gold mineral). Both deposits are also located next to a First Order fault structure (Catharine Fault Zone at Miller Property and the Larder Break at Kirkland Lake) potentially sharing a gold enriched magmatic reservoir at depth.

The Kirkland District is being explored by major and junior gold companies alike with some significant consolidation transactions recently announced and completed. Since going public by IPO in late 2020, Northstar has spent over $4.7 million in exploration at Miller, resulting in the discovery of a series of broad, near-surface, shallow dipping sheeted quartz-gold-telluride vein structures in the Allied Syenite (Allied Gold Zone) and Planet Syenites and numerous 70 – 750 gold gram/metre drill hole intercepts. Drilling to date at the AGZ has returned near-surface gold intercepts that include 6.6 g/t Au over 117.0 metres, 4.0 g/t Au over 50.6 metres, 1.4 g/t Au over 118.5 metres, and 1.2 g/t Au over 107.3 metres. Step out AGZ drilling in 2021 intersected peripheral steeply dipping copper-gold bearing structures (CG1 and CG2 Zones) returning intercepts that include 9.41 g/t Au, 1.03% Cu over 3.0m. The AGZ shares numerous compelling similarities to Agnico Eagle’s nearby Upper Beaver Deposit, currently in the pre-development stage.

In April, 2022, as a precursor to a Mineral Resource Estimate and for reporting purposes, the Company commissioned Ronacher Mackenzie Geoscience and SRK Consulting (Canada) to conduct an Exploration Target Study of the Miller Property Allied Gold Zone and No. 1 Vein. An upper range exceeding 500,000 ounces of gold averaging 2.04 g/t Au has been referenced in this study. Results were reported July 26, 2022, (Click here to view Northstar News Release dated July 26, 2022) verifying the significance, size and gold grade potential of the Allied gold mineralizing system. Results provide the Company and investors a fact-based conceptual tonnage and gold grade range for the Allied Syenite Gold Zone, and basis for continued expansion drilling and mineral resource development.

Northstar is positioning to conduct a Phase IIIA Allied Gold Zone lateral and depth expansion drill program on the Miller Gold Property this coming summer.

About Northstar Gold Corp.

Northstar’s primary exploration focus is the advancement of the Company’s flagship, 100%-owned Miller Gold Property, situated 18 km southeast of Kirkland Lake and Agnico Eagle Mine’s Macassa SMC gold mine. The Company’s strategy is to develop either a minimum material (+1 million ounce) high-grade gold mineral resource to potentially supplement a nearby mining operation or a stand-alone mining operation at the Miller Gold Property.

Northstar has 3 additional 100%-owned exploration projects in northern Ontario, including the recently acquired 1,200 ha Rosegrove Property situated 0.5 km from the Miller Gold Property, the 4,650 ha Bryce Gold Property (includes the recently optioned Britcanna Lease), an intrusive-gold / PME VMS project located along the projected east extension of the Ridout Break, and the recently expanded Temagami-Milestone Cu-Ni-Co Property located in Strathcona Township. Northstar recently filed a NI43-101 Technical Report on the Bryce Gold Property and is advancing all 3 properties to enhance monetization opportunities.

On behalf of the Board of Directors,

Mr. Brian P. Fowler, P.Geo.

President, CEO and Director

(604) 617-8191

bfowler@northstargoldcorp.com

Connect with us on Twitter | LinkedIn | Instagram

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, disclosure regarding the completion of the Debt Settlement. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks and uncertainties related to the completion of the Debt Settlement as presently proposed or at all. These risks and uncertainties are not, and should not be construed as being, exhaustive.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and the Company assume no obligation to update any forward-looking statements, except as required by applicable laws.